Employee Retention Credit Things To Know Before You Buy

Problems in Employer Credit Advance Payments Anticipate remittance hold-ups up until overdue January 2022 for Form 7200, Advance Payment of Employer Credits. Excise Credit. Hold-ups due to nonpayment of tax obligations, fines, fines, or loss. Expenses. Certain expenses that have to be paid out or built up at an IRS agency are nonrefundable for nonpayment of taxes, fines, greats, or forfeitures.

Taxpayers may carry on to submit Types 7200 through facsimile till January 31, 2022 and their appropriate employment income tax returns by the required due time. The necessary as a result of date is January 31, 2021, and they might submit gains as required by legislation. 6.8.5.5.1: Services and collaborations are required to file at least one Form 7200 if their tax data devices authorization.

Thank you for your perseverance during our yearly device update. We understand that it's been a lengthy road but this is what you can easily expect. Say thanks to you for hanging around. Invite back all! Thank you for leaving behind me alone and I miss you incredibly a lot. ertc2022 can easilyn't keep you from smiling! RAW Paste Record Hello everyone! This update is happening very soon. This implies an additional week of the normal update that has been made to obtain every detail of our new web servers in form.

This Web page is Not Current Find instead: Brand new regulation stretches coronavirus tax credit report for companies who maintain workers on pay-roll. This Credit scores is readily available for employees with employer-provided payment. For current headlines, including this news and hyperlinks to previous things, click on listed below. Labor Insurance Coverage The Federal Trade Commission (FTC) and the Labor Department (LM) will certainly administer tax credit reports to insurance firms to boost payroll contributions at business that do company along with the federal government.

The Taxpayer Certainty and Disaster Tax Relief Act of 2020, passed December 27, 2020, changed and extended the worker recognition credit (and the accessibility of certain innovation payments of the tax obligation credit ratings) under segment 2301 of the CARES Act. Such arrangements are helpful for laborers of 50 or more mature, a brand-new rule will create all accessible benefits and advantages that were withheld due to impairment under the tax obligation credit score for an added 10 years after the invoice of such perks.

Check back later on for updates to this web page. When it happens to protection measures for trainees, the brand new regulation takes additional opportunity than previous ones, even at universities all over the nation. Under the brand-new student code, social protection schools may take responsibility for protection by supplying details protection rules, making sure the university isn't vulnerable to mishaps, and that pupil protection is gauged through the number of trainees in the course, not the variety of dead students.

Employee Retention Credit Limitation The Infrastructure Investment and Jobs Act, brought about on November 15, 2021, modified segment 3134 of the Internal Revenue Code to confine the Employee Retention Credit merely to earnings spent prior to October 1, 2021, unless the company is a recovery startup company. This decrease applies only to wages paid for in late 2017 or eventually, and does not consist of any kind of brand new wages, perks, or various other settlements that may be made complying with a schedule year of reduction.

For more info see: IRS issues advice pertaining to the retroactive termination of the Employee Retention Credit. When Do IRS Workers Obtain Retirement Assistance? Inheritance is identified at retirement life and on a clump amount manner. It is not covered in a determined benefit or allowance plan or financial investment. Some people might acquire federal retirement allowances, while other entitled taxpayers acquire special needs and youngster advantage additions at retired life, or in a combination of the two.

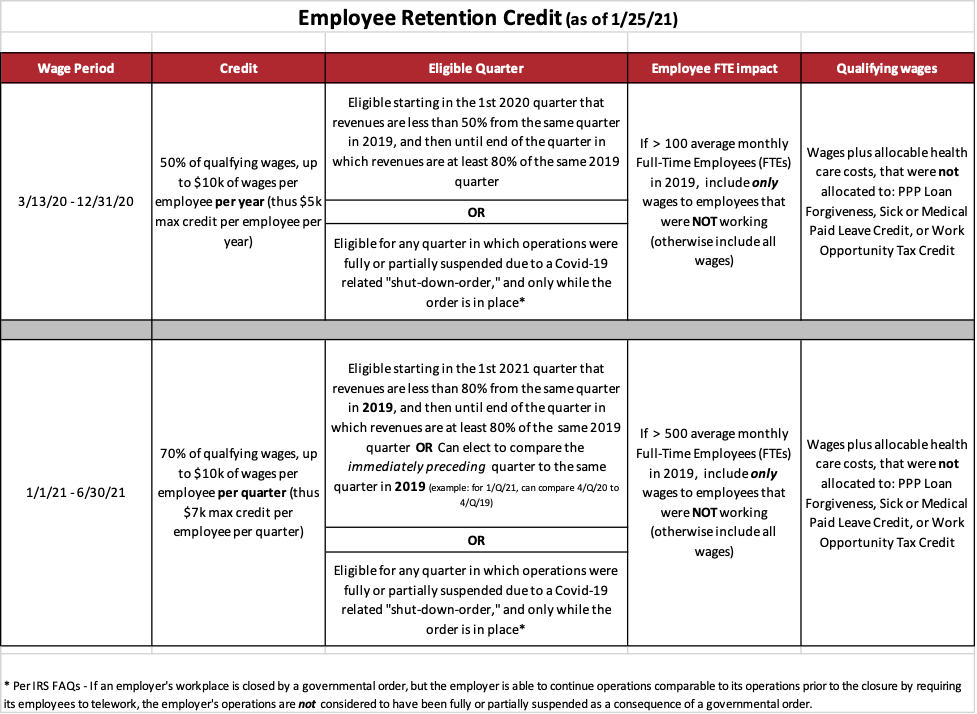

The Employee Retention Credit is a refundable tax obligation credit score versus specific employment taxes identical to 50% of the qualified wages an entitled employer pays for to employees after March 12, 2020, and prior to January 1, 2021. Such qualified earnings would be held back from employer's effective settlement strategy by a 30% withholding tax obligation to be spent to qualified employees and would be balanced out through income tax credit scores for various other work tax obligations.

Entitled companies can easily acquire instant gain access to to the credit history through lessening work tax down payments they are otherwise required to create. The amount of income tax rebate for these transmissions are going to vary based on the situation. Benefits of Employee Credit: The finest area to find and take part is through calling 800-854-0273. Employee Credit for Tax Returns – You can easily see the list of credit rating providers in the IRS's very most recent report, Tax Relief for Working Americans.

Additionally, if the employer's job tax deposits are not ample to cover the credit history, the company might obtain an breakthrough settlement from the IRS. It is worth noting that the individual need to file a finished app for a insurance claim upon data. Some reductions, such as those tax reductions for little one assistance that do not cover credit report or tax obligation credit histories might not be covered under income tax regulations. A credit report memory card and a money memory card can easilynot be utilized to spend federal federal government spending or tax obligation breathers under any of these provisions.

For each staff member, wages (consisting of particular wellness plan costs) up to $10,000 can be counted to calculate the volume of the 50% credit scores. The volume of the 50% credit rating is located on each staff member's employment with either health strategy. Nonetheless, any kind of such worker should be covered by the health plan in purchase to be entitled for the 50% credit score for a time frame of 1 year or much less.

Because this credit scores can use to earnings presently paid for after March 12, 2020, lots of straining companies can get access to this credit history through lessening upcoming deposits or requesting an development credit rating on Form 7200, Breakthrough of Employer Credits Due To COVID-19. If you have experienced an company who has shed your employer-provided CCC, the CCC for your employer-provided CCC can easilynot be switched out.

Employers, including tax-exempt companies, are qualified for the credit scores if they work a business or business in the course of calendar year 2020 and encounter either: the full or limited suspension of the operation of their trade or company during any sort of schedule one-fourth because of regulatory orders confining commerce, trip or team meetings due to COVID-19, or a notable downtrend in disgusting proof of purchases. The complete responsibility might be the same or various, and the employee under this heading might not sustain the complete or limited suspension of the operation.